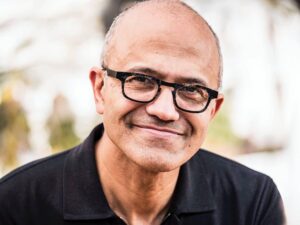

Satya Nadella Declares Second Search War On Google

Jaspreet Bindra

Not too long ago, marketers and search engine optimisers used to avidly watch out for something called the Google Dance. As the World Wide Web continuously expands with new websites, and pages are added and some deleted, Google’s famed search algorithm constantly adjusts their ranking. It crawls through these pages, gauges their relevance, sniffs out frauds, and modifies how sites appear on its page. This is what is called the Google Dance.

I thought of it recently when Satya Nadella, the CEO of Microsoft, revised the definition of Google Dance by saying in an interview, “I hope with our innovation they (Google) will definitely want to come out and show that they can dance. I want people to know that we made them dance.” This was the day that Microsoft and OpenAI launched an updated version of the search engine Bing, which integrated ChatGPT’s astonishing generative AI abilities with traditional search. Nadella called it a ‘new day’ in search, throwing down the gauntlet to the “800-pound gorilla”, and sparking off the Second Search Wars.

The First Search Wars started 14 years back, when Steve Ballmer and Microsoft launched the search engine Bing to take on Google. Google had annihilated other search engines like Yahoo, Lycos, and Excite to become a virtual monopoly, through a combination of superior search results and a profit-spewing business model.

Much like the First World War, the Bing-Google search war was a grinding battle fought in the trenches of technology. Google emerged victorious, still controlling more than 90 per cent of the search market as well as overtaking Microsoft in revenues and profitability. Microsoft vowed to soldier on, and Bing still exists, though as a very poor second alternative. Thus, the undisguised glee in Nadella’s tone when he declared the Second Search Wars.

The Second World War began with a blitzkrieg by the Germans as their tanks and artillery rolled over several European countries, the execution and sheer speed of it causing shock and awe across the world.

Microsoft started the Search war though its own blitzkrieg, as it speedily integrated OpenAI’s pathbreaking ChatGPT into its properties – Bing, the Azure cloud, Github, and its core Office software. It had patiently invested and partnered with OpenAI since 2019 and helped them develop their innovative products; recently it upped the game with a reported $10 billion investment. The patience is now paying off in spades, with the pace and scale of its execution taking the tech world by surprise. Tech experts are gushing about how startups could learn from the nimbleness of Microsoft’s execution.

The game that Nadella and Microsoft are playing is not about just winning in Search; in fact, a ChatGPT-like model will never replace Search. Google’s search business revenues at $225 billion dwarf Microsoft Bing’s more than 20-fold. With 8.5 billion searches a day, Google has the advantages of massive network effects, superior infrastructure and technology, and a brand which has become synonymous with search. It has fearsome AI capabilities too – its vaunted Search labs actually ‘invented’ transformers before OpenAI and GPT3, and it owns probably the best deep learning company in the world, DeepMind. It has had a ChatGPT-killer with it for many months now; its LaMDA or Language Model for Dialogue Application will soon be reborn as Bard. While Microsoft would definitely like to claw back some market share from Google – each percentage point of share is worth billions of dollars in revenue – its game goes much deeper.

Satya Nadella, as a commentator said on Twitter, is “playing 3D chess”.

At the heart of this game is the fact that Search is not Microsoft’s main business – it has market leading, super-profitable growth businesses in enterprise software, the cloud and gaming. Its search revenues are just around 5% of its total revenues. For Google, it is quite the opposite, with search advertising contributing 80% of its total revenue and almost its entire profitability. It is very likely that its other big businesses, like the cloud, lose money – it lost nearly half a billion dollars in Q4 2022. It is the big revenue gusher of search that boosts its investments in other ventures, mainly cloud.

Search advertising is extremely profitable for Google, and Microsoft now wants to attack it squarely. Nadella said as much in an interview with Financial Times: “From now on, the [gross margin] of search is going to drop forever.” The innovation sourced from OpenAI, combined with the hyperscale of Microsoft’s software products, will allow it to take users from Google. It will also subsidise advertisers to any degree, it has nothing much to lose. Again, Nadella alluded to this in his FT interview, saying, “There is such margin in search, which for us is incremental. For Google it’s not, they have to defend it all,”. It is this “asymmetric” competition which is enabling Microsoft’s jujitsu move. As Microsoft drives overall search margins down, it hits Google asymmetrically. That potentially impacts Googles investments in other businesses, including cloud, where it is locked in a ferocious battle with Microsoft for the number two position. Google has been subsidising its cloud growth with its search profits, and that tap could dry up. Meanwhile, Microsoft keeps making its money through its software and gaming businesses, offsetting its minuscule search losses. This is the ‘3D chess game’ that Microsoft is playing, a genius move in strategy.

Another issue for Google is that it might get mired in the famous Innovator’s Dilemma. Its world-beating advertising business model works well on how Search is structured today – as a massive searchable information database. If search becomes increasingly conversational, it is not sure that it can be monetized the same way as today’s search can. Thus, Google has a vested interest in ChatGPT or Bard-like conversational search not taking off – classic innovator’s dilemma. Finally, this is not the best timing for Google, as regulators and governments across the world are circling it to try and curtail its near monopoly in multiple areas of tech; it would welcome and encourage competition.

While this is fascinating to watch, there are many factors that could derail Microsoft’s ambitions. As I said earlier, one should underestimate Google at one’s own peril. It has vast resources, talent and innovation. Also, it is possible that products like ChatGPT are a flash in the pan, and the initial excitement might yet die out. Then, the real wars will be fought in the mobile space, where Android dominates and Google also powers search on iOS. Finally, generative AI models will have massive ethical issues like bias, plagiarism, fake news generation, environmental degradation, etc. which could slow down and even kill it. While Satya Nadella seems to be emerging as a champion jujitsu player, Sundar Pichai could still be the sumo wrestler who remains undefeated and standing.